Behind the scenes: Engineering Optiver’s global trading network

Introducing Optiver Tech Talks

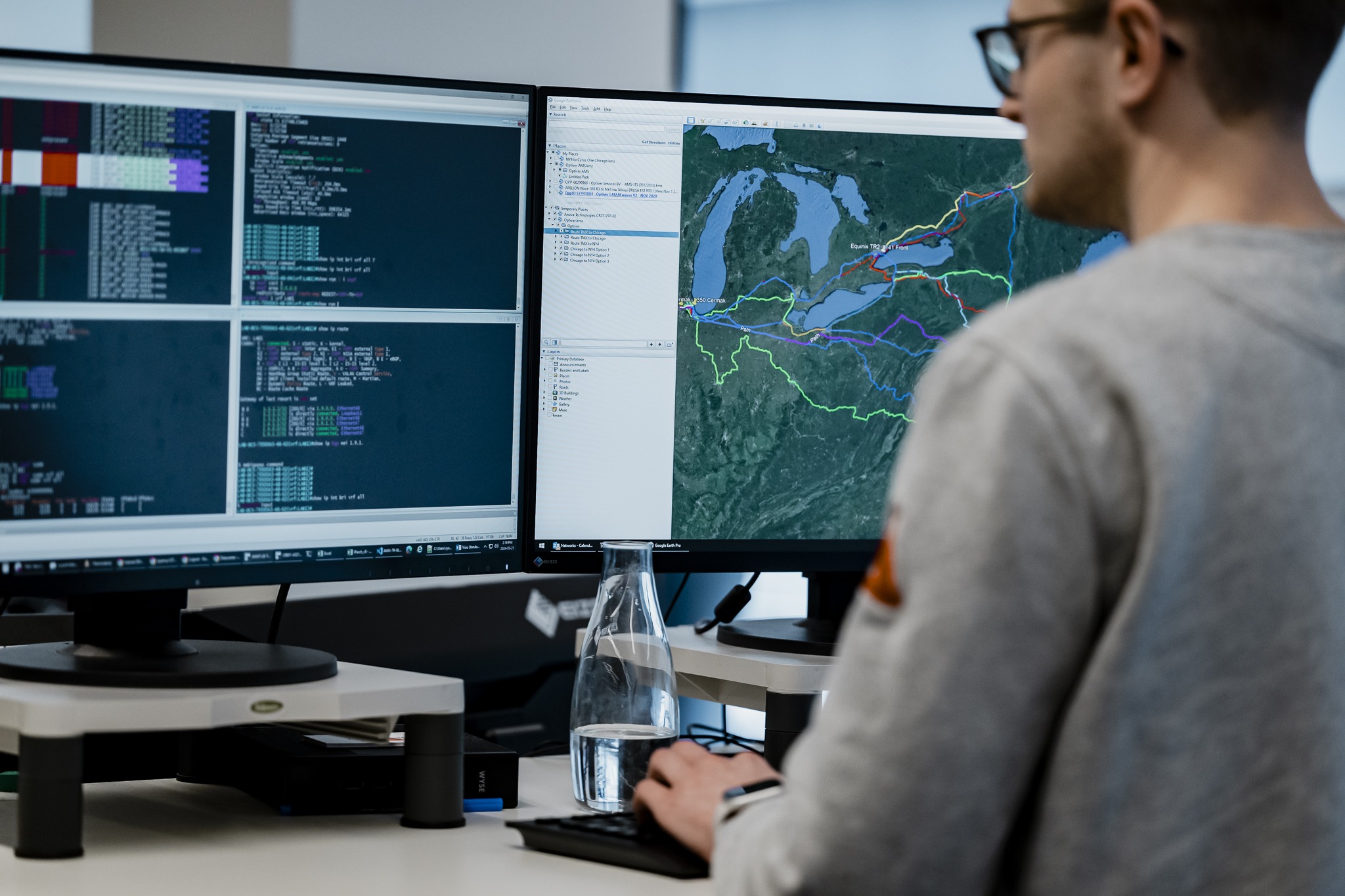

In Optiver’s Amsterdam office, our weekly Friday tech talks are a key part of our engineering culture. These sessions are a platform for our engineers to share updates from their teams, discuss new projects, and introduce new technologies they’re excited about. In the first blog post of the series, we’re spotlighting a recent talk given by Ryan, Network Engineer, offering a behind-the-scenes look at Optiver’s global trading network.

About the author

Ryan is a Network Engineer at Optiver. He joined Optiver as a university hire in 2016, and has worked in both our Chicago and Amsterdam offices.

If you’re reading this blog, you’re probably well aware that the vast majority of modern trading is done electronically. Traders define specific parameters that computers then use to execute trading decisions in less than a millisecond.

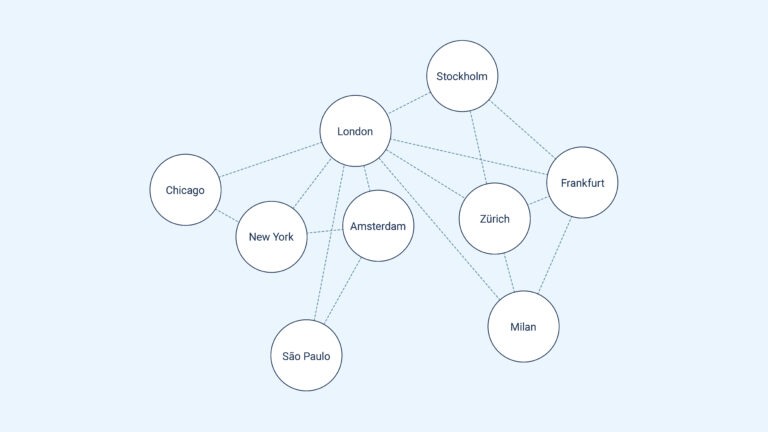

It’s no secret that to maintain a competitive edge in the fast-paced world of trading, proximity is key. The closer our servers are to the exchange’s servers, the faster we can execute trades—a critical factor in an industry where milliseconds can equate to significant financial outcomes. For this reason, Optiver strategically positions servers in numerous data centres (also called “colocations”) around the globe. Our trading network stands as the backbone of our operations, connecting our data centres across countries and continents.

In markets where even a five-minute outage can result in substantial opportunity costs for our trading operations, it’s crucial that we maintain fast, stable and dependable connections. These links bridge our main offices, which house our trading teams, with the data centres that host the exchange systems.

What does it take to build and maintain such a critical infrastructure? In this post, I’ll peel back the layers of our trading network, exploring the choices and challenges that keep our data—and our trades—moving swiftly and reliably throughout the trading day.

How Optiver’s data travels the globe

The first question you might ask is: How do we move data from point A to point B? While the internet might seem like the obvious solution, we don’t use it much in trading. The unpredictability and shared nature of the internet’s pathways make it less suitable for the critical nature of trading data. Instead, we turn to more specialised, reliable solutions.

Our network’s backbone consists largely of leased “wavelength” services—a dedicated lane of bandwidth on long-distance fibre optic cables. These fibre cables are often buried alongside railroads or highways, strung alongside aerial power lines, or laid on the ocean floor. From our perspective, it’s essentially a dedicated cable that connects our backbone router in one data centre to another.

This solution offers us control over the physical path and guarantees the bandwidth we need, ensuring that when we push data at up to 100 gigabits per second, we receive it unimpeded on the other side—since we have total control over the data flowing in this pipe, we will never have our trading data buffered behind other traffic.

Physical separation

When we order fibre line, we work with the vendors to design a path that best meets our needs. Oftentimes that means selecting the most direct path from one data centre to another, but sometimes there are specific geographic regions or obstacles we want to avoid.

Our Amsterdam office alone manages a network spanning 16 data centres across Europe and the Americas, connected by 40 trading WAN lines and approximately 75,000 km of fibre. This intricate web is not just about connectivity; it’s about resilience. Multiple diverse paths to each site ensure that a single failure—a cut cable or a natural disaster—doesn’t disrupt our trading activities.

Each segment of fibre faces its own set of risks. The vast majority of unplanned fibre outages that impact us are related to construction activities around the world. Typically, fibre cuts can be repaired within a day or two. For our cables which connect Europe to the Americas though, a ship’s anchor might slice through a subsea cable. Since a specialised cable repair ship will need to sail out and retrieve the broken segment of cable from the sea floor, these repairs can take much longer, sometimes up to a month or two. We even had one outage recently which we believe was caused by a shark bite!

Of course, fibre outages are inevitable. We configure our routers to automatically reroute via a backup path immediately when one of our primary fibre lines is cut. Therefore, we take great care in properly engineering our backup paths to be fully redundant. When choosing a new fibre route, we compare it to our existing paths. Our goal is to minimise overlap with our existing fibre paths to the greatest extent possible—sometimes even down to using separate entry points at the data centres. This strategy is key for the stability of our operations; it means that a single event, such as railroad construction in England, won’t disrupt our trading activities in Frankfurt.

Continuous improvement

As our network evolves, so do our strategies for maintaining and enhancing its capabilities. We are constantly evaluating new, faster paths, installing new connections to avoid overlaps, and increasing reliability as we build out new data centres to provide liquidity in markets where we already trade. The construction and maintenance of our trading network is crucial to maintaining the technical ingenuity and strategic foresight that Optiver brings to the trading world. By understanding the complexities and challenges of our global data transmission, we ensure that our operations run smoothly, efficiently and without interruption—a crucial edge in the fast-paced world of trading.

Explore our global engineering opportunities

Intrigued by the cutting-edge technology behind global trading? Dive deeper into the world of high-speed networks and explore our global career opportunities.